Savings plans for your goals

- New car

- House deposit

- Holiday

- Starting a family

- Debt repayment

Live your life free from money worries

- Initial 10 min chat

- Private & confidential

- Obligation-free

For over 25 years, MyBudget has helped 130,000+ Australians fast track their financial goals by reducing their debt and building savings.

For over 25 years, MyBudget has helped 130,000+ Australians reduce debt and grow savings.

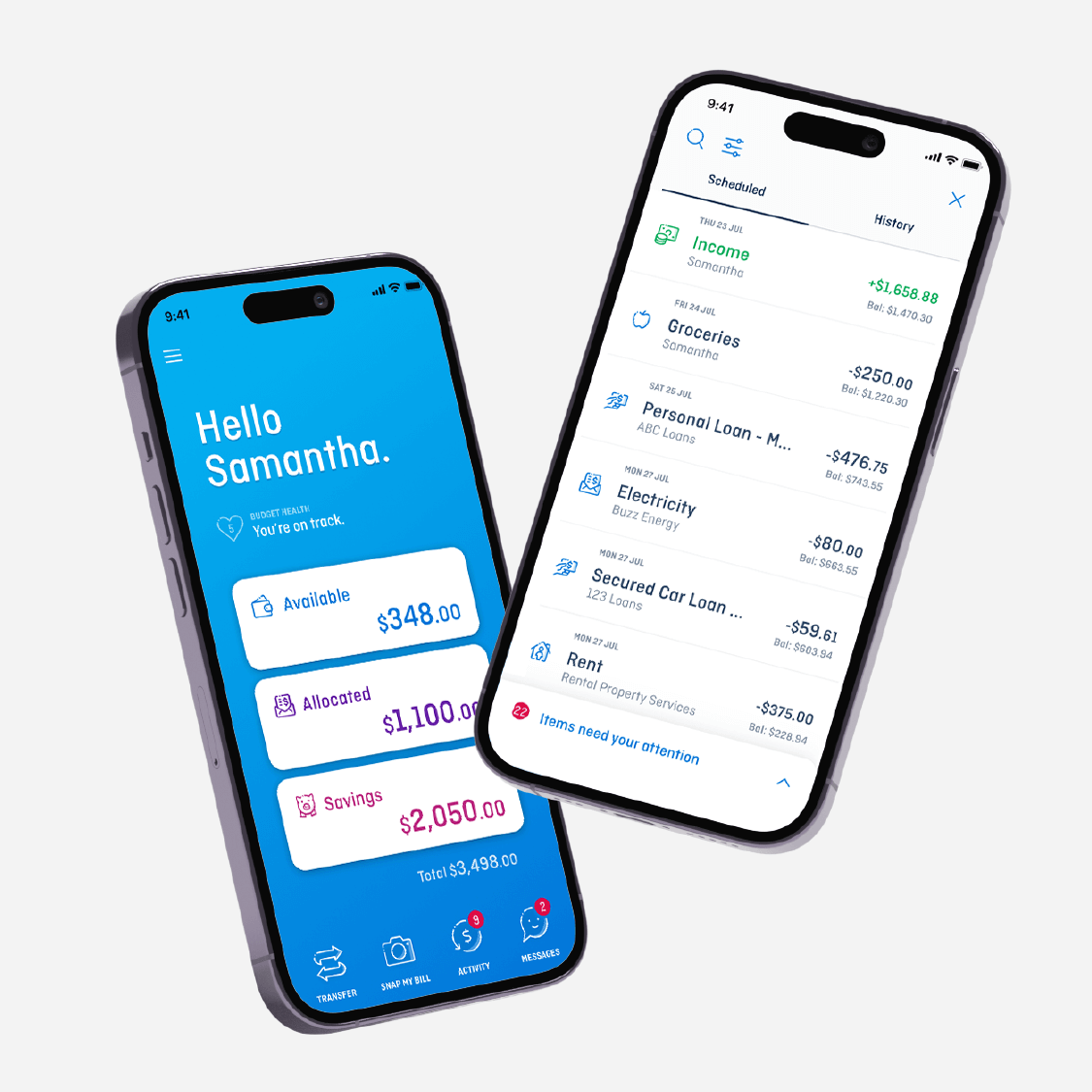

Watch your savings grow with our Budgeting App

- Track all of your money securely in one place with 24/7 visibility

- Take control of your money and make your money work harder for you with Australia’s trusted budgeting and money management app

- Keep track of your bills and payments to avoid any late fees

- Update your budget and create new savings goals.

What do you want to save?

On average, families save $3,500 for holidays each year with MyBudget.

Read Erin & Adam’s Savings Story

Like many Australians, they had stable incomes, but they felt like they should have more to show for it. They wanted to save for the future, have a financial buffer, and feel more in control of their money. What they didn’t have was a clear, structured plan to achieve those goals.

Saving for a house deposit

That’s when they decided to take action and partner with MyBudget. Today, they’ve saved over $70,000 — and it all started with a decision to make their money work smarter.

The realisation: “We can do better”

Before MyBudget, Erin and Adam’s approach to money was reactive. Bills were paid, essentials were covered, but they had no visibility into where their extra cash was going. “We knew we should be able to save more, but every month it felt like the money just disappeared,” says Erin.

This feeling is familiar for so many Australians. When you don’t have a clear system in place, money has a way of vanishing into small, unplanned expenses. Erin and Adam didn’t need to “tighten their belts” — they needed a better way to manage what they already had.

The turning point: partnering with MyBudget

Rather than being told to “cut back” or “make sacrifices,” they were shown how to organise their finances in a smarter way. Their MyBudget specialist helped them break down their expenses, structure their payments, and automate their savings.

They didn’t need to overhaul their lifestyle — they just needed a system that worked for them.

The plan: structure, automation & clarity

- Essential Expenses: Bills, rent, groceries, and everyday costs were automatically accounted for.

- Savings: A set percentage of their income was directed straight into savings with every paycheck.

- Spending Money: Their personal spending money was clearly allocated, so they had freedom to enjoy life without guilt.

The key to their savings success? Automation.

The result: over $70,000 saved without big sacrifices

“It wasn’t like we suddenly earned more money,” Erin says. “We just started managing it better.”

In total, they saved over $70,000 — without cutting out the things they loved. Their MyBudget plan didn’t ask them to give up everything. Instead, it gave them control, clarity, and confidence in their financial future.

Want to do better with your money?

- Plan Smarter: Get a clear plan for where your money is going.

- Automate Your Savings: Watch your savings grow automatically.

- Achieve Your Goals: Feel confident, in control, and ready for whatever comes next.

Live your life free from money worries

- Initial 10 min chat

- Private & confidential

- Obligation-free

Your MyBudget journey begins with an initial obligation-free conversation with one of our money experts. They will chat to you about your financial position and gain an understanding of the financial goals you want to achieve.

Discover the MyBudget difference

- We start by getting a full understanding of your financial situation and identifying areas where you might be able to find savings

- You’ll receive a FREE customised budget and savings plan, thats shows exactly how you can build your savings and reach your financial goals faster

- Our team of experts take the stress out of managing your money by providing ongoing support, so you can feel confident about your financial future.

A quick 10-minute call is all it takes to start your journey to greater savings and financial freedom.

Our services

Don’t just take our word for it

We’re often featured in many trusted sources

Money Saving FAQs

Can MyBudget assist with planning for larger savings goals, like a holiday or a house deposit?

How does MyBudget differ from other budgeting tools in terms of saving money?

Is MyBudget suitable for families who want to save for future expenses?

Can’t find what you’re looking for? More FAQs.