Money & Me: how to teach kids about money in Australia

Learn how MyBudget and Project Gen Z’s Money & Me program empowers Australian kids with essential financial literacy skills to make smarter money decisions and build a confident financial future.

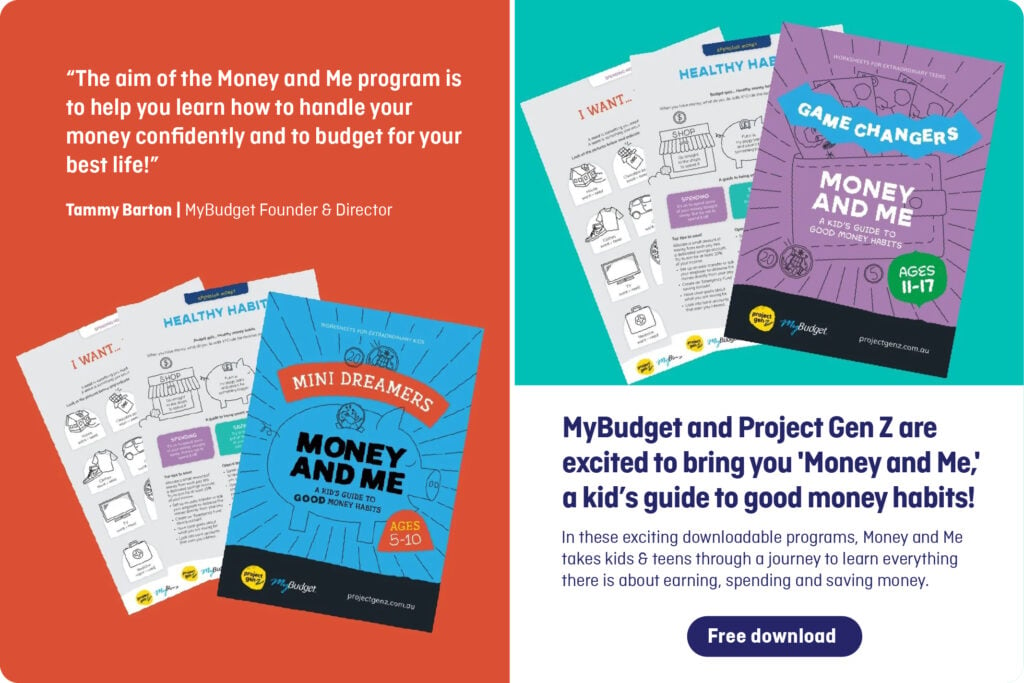

MyBudget is thrilled to partner with Project Gen Z to deliver the financial literacy program for Australian kids, Money & Me. This initiative equips children with essential money skills, arming them with the tools to make smart financial decisions. The goal? To set them up for a future of financial confidence. Want in? Keep reading to learn more — and find out how you can grab the workbooks for free!

Money and the ‘school of life’

Ever wonder why something as essential as money management isn’t fully covered in schools? While kids might pick up basic lessons on spending and saving, the bulk of financial education happens outside the classroom – in the ‘school of life’.

We learn from watching the people around us: how they manage money, where they succeed, and sometimes, where they stumble. For me, that learning started early.

Growing up in a household where money was tight, I watched my mum juggle a million responsibilities. By the time she was 24, she had four kids (including a son with disabilities). Budgeting wasn’t high on her list of priorities, yet she managed to be incredibly generous, sharing what little we had with others.

Then there was my dad, a self-employed builder. At 13, I stepped up to help with his bookkeeping. It felt like a puzzle I was meant to solve. Managing his cash flow taught me lessons I still carry today: the importance of balancing incoming and outgoing money, and the joy of being in control of finances.

More money, more choices

If I’m honest, many of my early lessons came from seeing what not to do with money. I vividly remember times when the electricity bill was overdue, and we were on the verge of having the power cut off. Yet those experiences shaped me.

While my friends spent their pay on nights out and trendy clothes, I was setting financial goals, like saving for my first home. And guess what? I enjoyed it. Saving became more than just a habit, it was a thrill.

Research backs up what I’ve experienced firsthand: kids who learn money skills early benefit in ways that ripple through their lives. They’re more likely to:

- avoid defaults and maintain higher credit scores

- build greater net worth during their peak earning years

- master smart shopping and spending habits

- manage debt effectively and decrease insurance costs

- gain confidence in financial decision-making.

I truly believe that teaching kids to handle money empowers them to dream bigger. And isn’t that what we all want for our children? To live lives full of purpose, untethered by financial stress or insecurity.

Supporting parents in teaching financial literacy

I know, teaching kids about money often feels like one more thing on an already overflowing parental to-do list. Especially when, let’s face it, many of us grew up winging it financially. (Raise your hand if you thought credit cards were free money until your first bill arrived!)

A Raiz survey found that 25% of parents received little to no money lessons growing up. No surprise then that so many of us feel a little lost when it comes to passing on good financial habits.

This is where MyBudget and Project Gen Z come in. Together, we’ve created a financial literacy program that makes teaching kids about money fun, practical, and dare I say… enjoyable?

Introducing Money & Me: a kid’s guide to good money habits

Money & Me introduces kids to practical money concepts that set them up for real-world financial success. The program includes two engaging workbooks:

- Mini Dreamers (ages 5-10)

- Game Changers (ages 11-17)

The workbooks are designed to be used with parents, teachers, or carers. They’re packed with light, fun, and practical activities – perfect for school holidays or rainy afternoons. My daughter Ellie recently completed the Mini Dreamers workbook and loved it!

Whether it’s through conversations about chores and pocket money or new teaching moments sparked by the activities, Money & Me helps kids develop real-world money skills and encourages them to set long-term financial goals.

Download the Money & Me workbooks for FREE

As part of MyBudget’s mission to eliminate financial stress in Australian communities, we’re offering the Money & Me workbooks for FREE.

Here’s how to grab your copy:

- Visit Project Gen Z Shop.

- Use the code MYBUDGET at checkout.

- That’s a saving of $19.99 per workbook!

The workbooks make financial education easy, fun, and accessible for the whole family. Don’t miss this opportunity to empower your kids with the skills they’ll use for life.

Live your life free from money worries

At MyBudget, we’re here to help you achieve your financial goals, whether it’s eliminating debt, building savings, or simply gaining peace of mind. We’ve helped over 130,000 Australians create financial freedom – and we can help you, too.

Enquire online or call us on 1300 300 922 today.

Start with a FREE no obligation appointment